In today’s fast-paced world, the convenience of managing finances on the go has become more vital than ever. Mobile wallets, also known as eWallets, have emerged as game-changers in the realm of digital finance, offering users a seamless and secure way to make payments, track expenses, and manage their money anytime, anywhere.

For anyone who owns a smartphone, including Android users, the possibilities are endless when it comes to harnessing the power of mobile wallets to simplify their financial lives.

Mobile wallets have revolutionised the way we handle our finances, replacing traditional methods of payment with digital alternatives that are faster, safer, and more convenient.

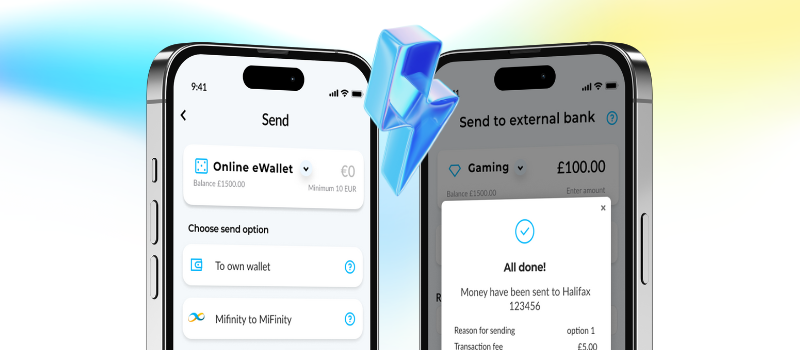

With just a few taps on their smartphones, users can store payment information, make purchases online and in-store, send money to friends and family, and even manage loyalty cards and coupons – all from the palm of their hand.

The Android Advantage

As the world’s most popular mobile operating system, Android powers a vast array of smartphones and tablets, offering users unparalleled versatility and customisation options. With millions of users worldwide, Android devices have become indispensable tools for both personal and professional use, making them the perfect platform for embracing the benefits of mobile wallets.

Why Consider eWallets for Payments?

Indeed, the benefits of digital wallets extend far beyond the convenience of digital payments. Here are some compelling reasons why Android users should consider adopting eWallets for their financial transactions:

- Convenience: With a mobile wallet, users can leave their physical wallets at home and rely solely on their smartphone for all their payment needs. Whether shopping at their favourite retail stores or ordering food online, the convenience of having all payment methods stored digitally is unmatched.

- Security: Mobile wallets employ advanced encryption and authentication measures to safeguard users’ payment information, significantly reducing the risk of fraud and unauthorised transactions. In addition, features such as biometric authentication (such as fingerprint or facial recognition) add an extra layer of security, ensuring peace of mind for users.

- Cost Savings: Using a mobile wallet can help users save money by avoiding transaction fees associated with traditional payment methods such as credit cards or bank transfers. Many eWallet providers offer competitive exchange rates and may even offer cashback rewards or discounts for using their services.

- Accessibility: Mobile wallets are accessible to anyone with a smartphone, making them an inclusive and convenient payment solution for individuals of all backgrounds and financial situations. Whether you’re a frequent traveller or a busy professional, having access to your finances on your mobile device ensures you’re always in control of your money.

With such a wide range of choices available, Android users can easily find the perfect mobile wallet that matches their lifestyle.

Download the MiFinity App Today

To experience the convenience and security of the MiFinity eWallet on your Android device, simply head to the Google Play Store now. Install the MiFinity app with just a few taps and unlock a world of seamless payments, instant transfers, and more. Don’t miss out on simplifying your finances – download MiFinity today and take control of your money anytime, anywhere.