In order to remain competitive in today’s fast-paced digital landscape, it is essential for small businesses to stay ahead of the curve. With technology evolving at an unprecedented rate, embracing digital transformation has become more than just a trend—it’s a strategic imperative. In this comprehensive guide, we’ll explore what digital transformation entails, why it’s essential for small businesses, and how to navigate the process effectively.

Understanding Digital Transformation: What Is It?

Digital transformation refers to the integration of digital technologies into all aspects of a business, fundamentally changing how it operates and delivers value to customers. It’s not just about adopting new tools or systems but rather reimagining processes, workflows, and customer experiences in a digital-first manner. From automating manual tasks to leveraging data analytics for informed decision-making, digital transformation empowers businesses to adapt, innovate, and thrive in an increasingly digital world.

Why Digital Transformation Matters for Small Businesses

In today’s digital age, consumers expect seamless online experiences, instant access to information, and personalised interactions. For small businesses, embracing digital transformation isn’t just about keeping up with the competition—it’s about meeting customer expectations and staying relevant in a rapidly evolving marketplace.

By harnessing the power of digital technologies, small businesses can enhance operational efficiency, reach new customers, and unlock new revenue streams. Moreover, digital transformation enables businesses to future-proof their operations, ensuring they remain agile and adaptable in the face of technological disruptions.

Digital transformation is like a toolbox filled with exciting gadgets that can revolutionise the way businesses operate. Let’s take a peek at some of the best tools:

Firstly, cloud computing can give your business wings by allowing you to move your entire IT setup to the cloud. With this technology, you can scale up or down effortlessly, save costs, and enjoy flexibility.

Similarly, utilising data analytics enables you to extract valuable insights about your customers, market trends, and business performance, empowering businesses to make informed decisions.

What’s more, e-commerce solutions can help you take your business global by setting up shop online. With this technology, you’ll reach customers far and wide, streamline transactions, and make shopping a breeze.

Automation can help you banish repetitive tasks to the land of automation. By automating workflows, you’ll turbocharge efficiency, eliminate errors, and give your employees more time to do the things they love.

Navigating the Digital Transformation Journey

Embarking on a digital transformation journey in business is akin to setting sail on a strategic voyage. Here’s your comprehensive guide:

- Initial Assessment: Start by taking stock of your current business operations. Evaluate your processes, technologies, and team capabilities. Identify areas where digital enhancements can make a difference. This introspective analysis provides a clear picture of your starting point and the challenges ahead.

- Setting Clear Objectives: With a solid understanding of your business landscape, define clear and achievable objectives. Whether it’s improving customer satisfaction, streamlining operations, or entering new markets, setting specific goals helps focus your efforts. These objectives serve as guiding stars, steering your digital transformation journey towards success.

- Development of a Strategic Roadmap: Craft a detailed roadmap that outlines the steps needed to achieve your objectives. Break down your transformation journey into manageable phases, each with its own milestones and timelines. Consider factors such as budget, resources, and potential roadblocks. A strategic roadmap provides a clear path forward, keeping your team aligned and accountable.

- Cultivation of an Innovative Culture: Foster a workplace environment that encourages creativity, experimentation, and collaboration. Embrace new ideas and perspectives, and celebrate successes along the way. Encourage your team to think outside the box and explore new possibilities. An innovative culture breeds resilience and adaptability, essential qualities for navigating the ever-changing digital landscape.

- Progress Monitoring and Adaptive Iteration: As you embark on your digital transformation journey, track your progress closely. Monitor key performance indicators and milestones to gauge your success. Be prepared to adapt and iterate your strategy as needed, based on feedback and evolving market trends.

The Benefits of Partnering with an eWallet Payment Provider

Partnering with an eWallet payment provider offers numerous advantages for small businesses seeking to streamline their financial operations and enhance the customer experience.

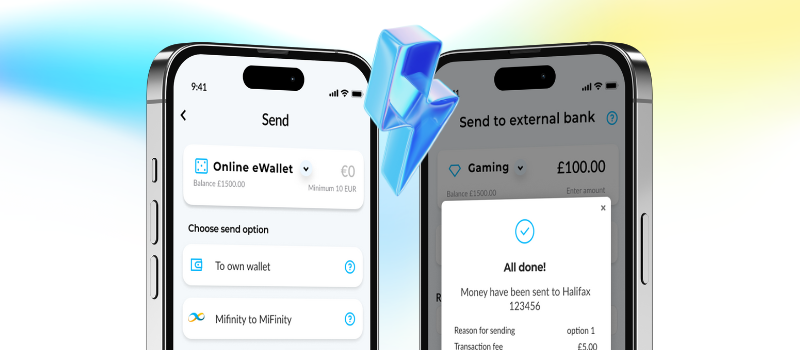

Firstly, eWallets enable businesses to offer customers a convenient and secure payment option, accommodating diverse preferences and lifestyles in today’s digital era. By accepting e-wallet payments, businesses can cater to the needs of consumers who prefer the ease and efficiency of mobile transactions. Additionally, eWallet payment providers often offer robust security measures, including encryption and fraud detection, to safeguard sensitive financial data, instilling trust and confidence among customers.

Digital wallets like MiFinity facilitate faster transactions and reduced processing times, improving cash flow and operational efficiency for small businesses. Lastly, partnering with an eWallet payment provider opens doors to global markets, allowing businesses to accept payments from customers worldwide and expand their reach beyond geographical boundaries.

At MiFinity, we are committed to empowering businesses with cutting-edge eWallet solutions that streamline payment operations, enhance security, and fuel growth. Contact our sales team and join us on the journey towards a more efficient and seamless future for merchant payments.