Today, managing your finances online has never been easier, but it’s crucial to ensure that the tools you use to store and access your funds are secure. A secure digital wallet is a must-have for anyone looking to make seamless, efficient, and protected online transactions. As digital wallets become more popular, innovative security features, such as biometric authentication, are being integrated to enhance protection and provide users with peace of mind.

What Is a Secure Digital Wallet?

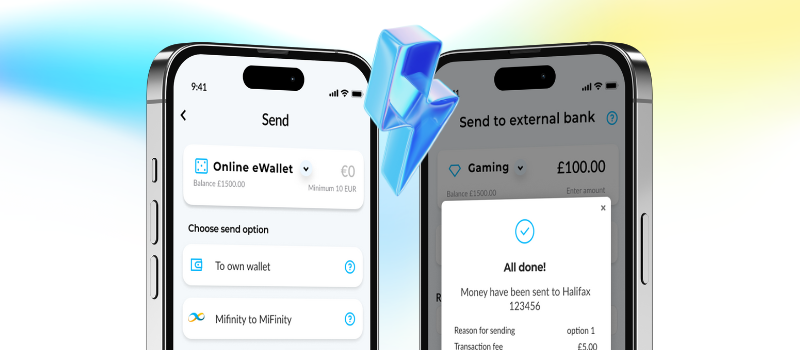

A digital wallet, also known as an eWallet, is a tool that allows you to store, send, and receive money online. It functions like a virtual version of your physical wallet, holding your funds (in multiple currencies if required) so you can transact online without needing a bank account or traditional payment card. To protect your funds and personal information, a secure digital wallet incorporates state-of-the-art security measures such as encryption, two-factor authentication, and, increasingly, biometric security.

What Is Biometric Security?

Biometric security is a type of authentication that relies on unique biological characteristics, such as fingerprints, facial recognition, or voice patterns, to verify a user’s identity. Unlike passwords or PINs, which can be forgotten, stolen, or hacked, biometric data is much harder to replicate, making it a more secure and reliable option for protecting your digital wallet.

By using biometric security, digital wallets add an extra layer of protection, ensuring that only you can access your funds, even if someone else gets hold of your device. This feature has quickly become one of the most trusted forms of authentication on mobile devices, providing consumers with an enhanced level of security and convenience.

How to Compare Digital Wallets for Security

When selecting a digital wallet, it’s important to consider a variety of security features to ensure that your money and data is well-protected. Here are some tips to help you compare different digital wallets and find the most secure option for your needs:

- Biometric Authentication: Ensure the wallet supports biometric security features like fingerprint scanning or facial recognition. These advanced measures help prevent unauthorised access and provide more security than traditional passwords alone.

- Encryption: Look for wallets that offer end-to-end encryption, which ensures that your personal and financial information is protected from hackers during transactions.

- Two-Factor Authentication (2FA): A secure digital wallet should provide two-factor authentication, requiring an additional form of identification, such as a code sent to your mobile phone, to access the account.

- Real-Time Monitoring and Fraud Detection: Some digital wallets offer real-time fraud detection that alerts you to any unusual activity. This feature can quickly help you spot potential threats and take action before any damage is done.

- Reputation and Reviews: Always check the reviews and reputation of the digital wallet provider. Opt for established brands that have a proven track record in various secure payment services.

MiFinity eWallet: A Secure Digital Wallet

When it comes to choosing a secure digital wallet, the MiFinity eWallet stands out as a best-in-class solution. MiFinity prioritises security with a range of advanced security features, including biometric authentication. This ensures that only you can access your eWallet, providing an additional safeguard against unauthorised users. With fingerprint or facial recognition integrated into the MiFinity eWallet, your digital transactions are more secure and convenient than ever.

MiFinity also incorporates other top security features, such as encryption and two-factor authentication, to provide a robust defense against potential threats. By combining these technologies, MiFinity ensures that your funds and personal information remain safe at all times.

In addition to strong security measures, MiFinity offers an intuitive and customer-friendly user experience, making it a great choice for cost-effective transactions across various platforms, whether you’re shopping online, transferring money, or using services like iGaming.

If you’re ready to enhance your online security, explore the MiFinity eWallet and how we protect your data here.